Raising Money-Smart Kids: Age-by-Age Financial Lessons

FOUND IN SENATE CENTS

Published: April 9, 2025

April is Credit Union Youth Month, and there's no better time to focus on helping your child learn smart money habits that will last a lifetime. Here's a breakdown of age-appropriate money lessons to help you raise money-smart kids from preschool through high school.

2025 Senate State Staff Conference

FOUND IN USSFCU CORNER

Published: April 10, 2025

Senate staff is eligible for membership, even outside of the DMV area.

Making the Leap: Turning Your Side Hustle into a Full-Time Business

FOUND IN SMALL BUSINESS CORNER

Published: March 12, 2025

If your side hustle is bringing in steady income, taking up more of your time, and showing strong growth potential, it may be time to consider making it your full-time business. Transitioning from part-time entrepreneur to full-time business owner requires financial planning, a solid strategy, and the right mindset.

Contactless Payments: Safe, Secure & Built for Speed

FOUND IN SECURITY CORNER

Published: April 18, 2025

As technology continues to evolve, so do the ways we make purchases. From tapping your card to paying with your phone or smartwatch, contactless payments are quickly becoming the go-to method for fast, convenient, and most importantly, secure transactions. At USSFCU, your financial safety is our top priority. That's why we're sharing the facts on how these modern payment methods work and why you can trust them.

USSFCU Recognized Nationally Again as a 2025 USA Today Top Workplace

FOUND IN PRESS RELEASES

Published: April 18, 2025

USSFCU is proud to announce that it has once again been named a 2025 USA Today Top Workplace, a national recognition that celebrates organizations with exceptional workplace cultures.

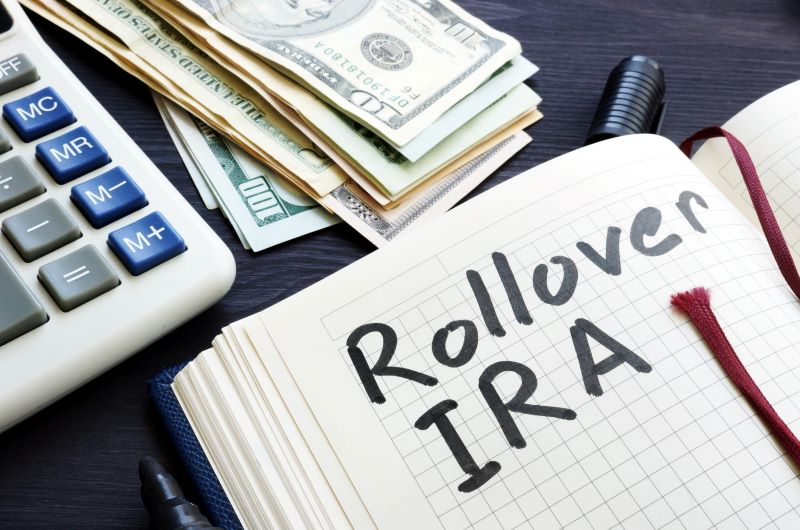

IRA Rollovers: When, Why, and How to Do It Right

FOUND IN ADVISORS' CORNER

Published: April 18, 2025

Changing jobs? Retiring? Or simply looking for more control over your retirement savings? An IRA rollover might be the right move, and understanding how it works can help you avoid costly mistakes. Whether you're moving funds from a 401(k) or consolidating old retirement accounts, here's what you need to know to roll over your retirement savings the smart way.

Senate Cents

Senate Cents USSFCU Corner

USSFCU Corner Small Business Corner

Small Business Corner Security Corner

Security Corner Press Releases

Press Releases Advisors' Corner

Advisors' Corner