5 Social Security Myths Debunked

By: Fidelity Viewpoints - 9/13/19

Published: September 26, 2019

Key takeaways

- Many people believe that everyone must claim their Social Security benefits at age 62. That is a myth: 62 is the earliest age you can claim your benefit, but it’s not the only age.

- Waiting to claim Social Security until after your full retirement age (FRA) comes with a bonus: 8% additional monthly income per each year you wait.

- Your ex-spouse has no influence over your benefits.

- If you were married for 10 consecutive years and have not remarried, you are entitled to either your own benefit—or 50% of your ex’s Social Security benefit, whichever is higher—once you reach your FRA.

Getting your arms around Social Security can be pretty complicated. Misinformation, partially informed opinions, and complex benefits formulas can easily lead one down an incorrect—and costly—path. That's why it is important to work with your financial advisor to develop a Social Security claiming strategy that can serve as the foundation of your overall retirement income plan.

Before you make your decision about claiming this valuable benefit, let's clear up 5 of the most common myths and misperceptions about Social Security that could undermine your ability to generate the income you’ll need in retirement to live the life you want.

Myth #1: You must claim your Social Security benefit at age 62

Many people are adamant that Social Security benefits must begin at age 62. This is a myth: 62 is the earliest age you can claim your benefit, but it's not the only age.

Your base benefit is calculated based on your "full retirement age," or FRA. Your date of birth determines your FRA. Your base benefit is calculated by the Social Security Administration based on your average indexed monthly earnings during the 35 years in which you earned the most (only the years that you paid Social Security taxes).

Tip: You'll find your FRA at Social Security's website, SSA.gov, or on a paper statement mailed to you by the Social Security Administration. For those born between 1943 and 1954, your FRA is 66. Those born later have an FRA of 66 (plus some months) or an FRA of age 67.

If you claim any time before your FRA, you lock in a permanent reduction in monthly income. Claiming at 62 translates to a reduced monthly income of 25% to 30%, depending on your FRA. That means you may receive a lot less monthly retirement income, every year, for potentially several decades. You might think you are not going to live a long life, but many people do: For people age 65 today, 25% of men will live until 93; 25% of women will live to 95.1 A key consideration for when you claim Social Security is maximizing your income for a retirement that could last longer than 30 years.

Wait until age 70 and lock in a "bonus":

- Waiting to claim Social Security until after your FRA comes with a hefty bonus: 8% additional monthly income per each year you wait.

- If your FRA is 66, your monthly income would increase 32% by waiting.

- If your FRA is 66 years and 6 months (if you turn 62 in 2019), your monthly income would increase 28% by waiting.

- If your FRA is 67, your monthly income would increase by 24% waiting.

Read Viewpoints on Fidelity.com: Longevity and retirement

Myth #2: You'll never get back all the money you put into the program

Although 70% of the respondents from our survey2 thought they might not get back all the money they put in, many will. Everyone’s situation is different. Simply put, if you live a long time, you may collect more than you contributed to the system.

Due to the complexity of claiming strategies and number of variables involved, the Social Security Administration no longer offers a break-even calculator on its website. Social Security is designed to provide a safety net of income for the retired, the disabled, and survivors of deceased insured workers. The contributions you and your employers make during your working years provide:

- Current retirees and other Social Security recipients with payments

- A guaranteed income benefit when you reach retirement

While the government does not have a specific account set aside just for you with your FICA contributions (the taxes for Social Security and Medicare paid by you and your employer), one of the most powerful features of Social Security is that it provides an inflation-protected guaranteed income stream in retirement, ensuring against the risk you will outlive your savings. Even if you live to 100 or more, you continue to receive income every month. And, if you predecease your spouse, your spouse also receives survivor benefits until their death.

Myth #3: My ex-spouse's actions could negatively impact my Social Security benefit

In a survey,3 Fidelity asked more than 1,000 people if an ex-spouse could influence their Social Security benefits—52% of them said yes, this is true.

The real answer: False.

There are a lot of things an ex-spouse might do to complicate your life, but Social Security is off limits. Your ex has no influence over your benefits. If you have an ex-spouse, you may be entitled to spousal benefits as if you had remained married. If you were married for 10 consecutive years and have not remarried, you are entitled to either your own benefit—or 50% of your ex's Social Security benefit, whichever is higher—once you reach your FRA.

If you wish to claim on your ex-spouse's benefit, you simply make an appointment with your local SSA office and bring documents that prove the marriage and divorce. They will calculate your benefit options, and when you submit your claim, you’ll receive the higher benefit.

Tip: There's no need to discuss this with your ex-spouse, and your claim does not reduce or affect your ex's benefit in any way. It's your benefit, even if you've been divorced for many years. And, it may be larger than your own individual benefit. Read Viewpoints on Fidelity.com: Unraveling Social Security rules for ex-spouses

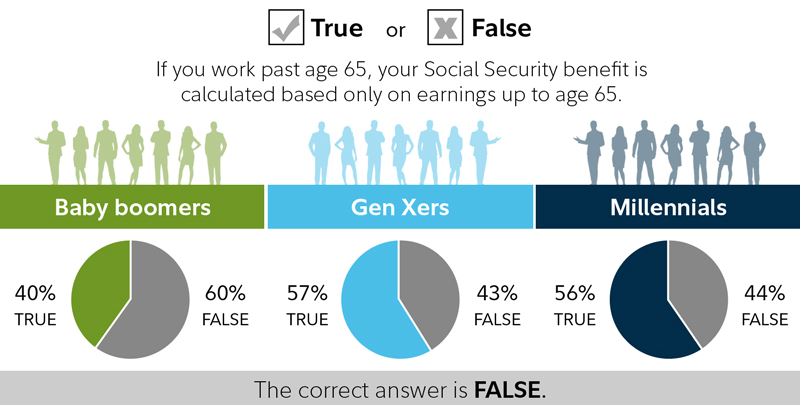

Myth #4: Your benefits are only based on wages that you've earned before age 65

- How your Social Security benefit is calculated can seem mysterious. However, it’s important to know a few essential facts to aid your claiming strategy. You can use the tools on SSA.gov to do the calculations.

- Your benefit is calculated based on your highest 35 years of earnings; they do not have to be consecutive years or before age 65.

- If you work past age 65, those earning years will be included, so long as they are high enough to be part of your highest 35 years.

- Even working part-time after turning 65 may be part of your highest 35 years of earnings.

- To be eligible for Social Security, you must have a minimum of 10 years of covered employment, which equates to 40 credits in the Social Security system.

- If you don’t have 35 years with earnings, zeros will be included in the calculation.

Read Viewpoints on Fidelity.com: Social Security tips for working retirees

Myth #5: You can claim early, then get a "bump up" once you reach full retirement age

Many believe there is a "bump up" or "added income" once they reach their full retirement age. They've heard they can claim early at 62, then when they reach 66 or older, their checks will increase to the amount that corresponds to their full retirement age benefit. That's a big misperception.

There is no bumping up of income once you've claimed your Social Security retirement benefit. However, anyone receiving a benefit can voluntarily "suspend" that benefit after they reach FRA and resume it as late as age 70. If they do, the annual benefit will increase by 8% until age 70. After that, you get an annual cost of living adjustment, but no increase in your base benefit, which will start automatically the month you reach age 70 unless you specify otherwise.

In general, you can cancel your Social Security claim if you do so within the first 12 months of receiving benefits.2 You must repay the full amount you've received, and the full amount a current spouse or family member received based on your benefit. Then, you are eligible to claim again at a later date and will receive a larger monthly payment. Each individual can only cancel a claim once in their lifetime.

Case Study: Lower-income spouses may get a "top up" or "auxiliary" benefit.

There is, however, one case where you could get a "top up" benefit at FRA, but you still need to wait until your FRA to claim your Social Security benefit. In this hypothetical example, Sally earned less during her career than her husband Brad. Her FRA benefit is $700 per month; his is $2,000. As a spouse, she's entitled to 50% of Brad's benefit if she claims at her FRA. She would receive a "top up" of $300 to bring her benefit up to the $1,000 (half of Brad's benefit) to which she is entitled. Social Security will calculate her options and pay out the higher benefit to which she is entitled.

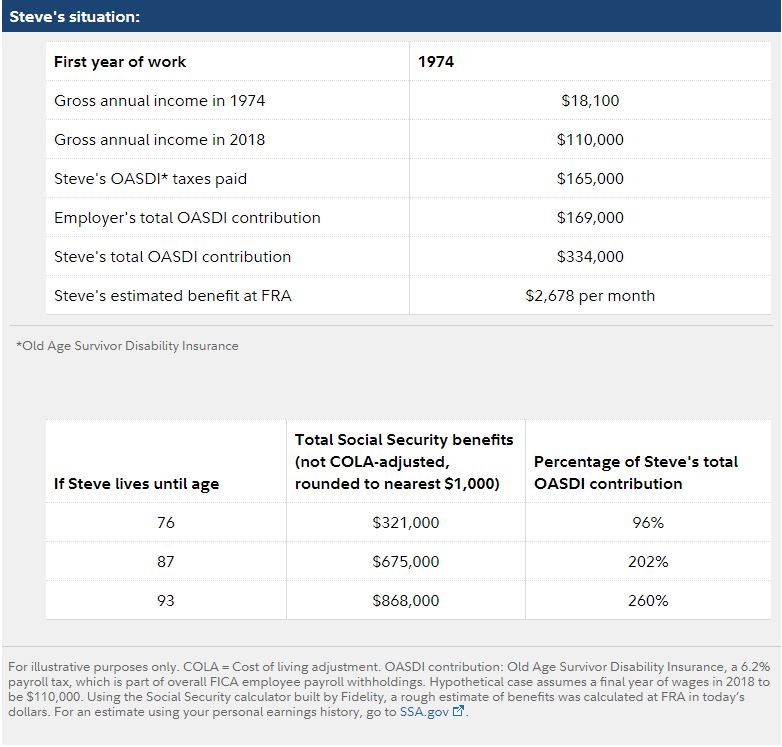

Social Security: Your contributions vs. potential benefits

Let's look at a hypothetical case of Steve, who reached his FRA in 2018. He retired in December 2018 and began collecting his Social Security benefit in January 2019 at his FRA. In Steve's case, if he lives past age 76½, he will receive a larger benefit than he contributed to the system. There is no standard break-even point, but let's look at Steve's situation in more detail.

Checklist for your Social Security claiming strategy

- Know your numbers. Find out your FRA, earnings history, and estimated benefits.

- Stay current. Sign up for your most current statements on SSA.gov.

- Do the math. Use calculators on SSA.gov to check out your monthly benefit options.

- Get the facts. Don't succumb to myths; use primary resources such as SSA.gov.

- Start planning early. Claiming Social Security is an important part of your retirement income plan, but it takes some time to understand the options—and the implications to your savings. Social Security can form the bedrock of your retirement income plan. That's because your benefits are inflation-protected and will last for the rest of your life. Consider working with your Fidelity financial advisor to explore options on how and when to claim your benefits.

Disclosures:

1Society of Actuaries RP-2014 Mortality Table projected with Mortality Improvement Scale MP-2017 as of 2018. Healthy annuitants group is used as mortality group. 2 This Fidelity-sponsored study presents the findings of an online survey conducted among a sample of 1,023 adults comprising 512 men and 511 women 18 years of age and older. Interviewing for this CARAVAN®Survey was completed on September 15–18, 2016, by ORC International, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. The scope of the survey was limited to Social Security Retirement benefits and certain forms of Spouse and Survivor benefits, and did not include questions related to Disability or Supplemental Security Income.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

This article originally appeared on Fidelity.com/veiwpoints. To read the article in its original posting please visit Fidelity.com/viewpoints/retirement/social-secuirty-myths.