How to Evaluate a Job Offer

By: Fidelity Viewpoints

Published: August 17, 2021

Key takeaways

- It's more than just salary: Think about how a new job could impact your entire life including taxes, your commute, and your retirement.

- Intangible factors like a desire to move, the ability to advance your career, or quality of life are important too. Decide how much weight they should have in your job search.

Got a sweet new job offer? Take the time to see how changing jobs could affect your lifestyle and your financial picture. Here are 6 key things to consider.

1. Money

Compensation is often more than just a base salary. Is there a cash bonus or commissions? While your base salary is generally fixed, a bonus and commissions aren't guaranteed and may vary from year to year. Will you be paid for overtime? Does the company offer stock compensation?

2. Benefits

Many employers provide a workplace savings plan match program, profit sharing, tuition reimbursement, life insurance, flexible spending accounts, health insurance, disability insurance, and paid time off. Assistance with student loan debt is increasingly being offered as a workplace perk as well.

These benefits can really add up, and it is important to take them into account when comparing a job offer to your current position. Say you currently get a 4% employer match, meaning that if you contribute 4% of your salary to your 401(k), your company will contribute 4% on your behalf. For someone making $50,000 per year, that would mean an additional $2,000 of "free" money every year.

3. Taxes

Taxes are also key. If the new job involves moving to a new state, check the state income tax rate. Let's say you currently live and work in a state with no state income tax. The job offer is in a state that has an effective state income tax rate of 5%. For a person earning $40,000, that is an additional $2,000 a year in taxes. Some areas have a local municipal tax as well.

The list of potential taxes doesn’t end there. States and cities around the country may collect taxes in different ways: There may be sales tax, property taxes, estate taxes, or excise taxes to consider.

Your payroll taxes may change too. What if you are going from being a wage-earning employee1 to a self-employed contractor2—or vice versa? Payroll taxes on workers' wages include 15.3% for Social Security and Medicare. Your company pays half of these payroll taxes. As a contractor, however, you are the employee and the employer, which means you'll have to pay all those taxes.

Of course, there are some potential tax benefits to being self-employed. For example, if you itemize, you'll generally be able to deduct expenses like the cost of using a car for business purposes or maintaining a home office. So, be sure to weigh all the potential costs and benefits.

4. The cost of living

Relocating for a new job may come with a price besides the cost of the move itself. In addition to the previously mentioned tax considerations, the cost of living in a new location may increase or decrease the real value of your compensation package. Everything from the cost of utilities and insurance to food and entertainment can vary greatly across the country. The cost of driving can be a big factor as well—the cost of car insurance and gas prices may be more or less expensive in another part of the country.

Let's say you are making $50,000 in your current job, and you have a job offer in another state for $60,000. The cost of living in the new state is 50% higher than your current state, so you would have to earn about $75,000 in your new state to afford the same lifestyle. On the other hand, moving to a lower-cost area may mean a small raise may go a long way.

5. The cost of leaving a job

Leaving your current job may also cost you, so to speak. You may lose what your employer contributed to your 401(k), stock options, or other stock compensation—or all 3—if you weren't at the job long enough to be vested.

For example, let's say your company contributed $10,000 to your 401(k) plan and it will vest at 20% per year over 5 years. So if you leave after the end of the first year, you could keep only $2,000 of the contribution. After 2 years, you could keep 40%, and so on.

Did you take a loan from your 401(k)? If so, generally you will need to repay the full amount after leaving the company, or else the outstanding balance will be treated as a taxable distribution and also may be subject to a 10% early withdrawal penalty.3

Some people do still have a defined benefit plan or pension at work. Making the decision to leave a job with access to a defined benefit plan comes with a unique set of considerations. After employees reach a certain age, pensions make regular payments for life. The size of the payment depends on salary and length of service. It can be a valuable benefit and may not be easily replaceable.

6. Other costs and considerations

If you have to relocate, you may have to pay for moving costs, real estate agent fees, or temporary housing. Some companies cover these costs for new employees, but not all do. You may also want to find out when you will be eligible to participate in the new employer's retirement plan and when you will be eligible for a company match. Your new offer may have an allowance for these costs and a make-whole provision, meaning it would make up what you would lose in unvested benefits, bonuses, and other compensation when you leave your current job.

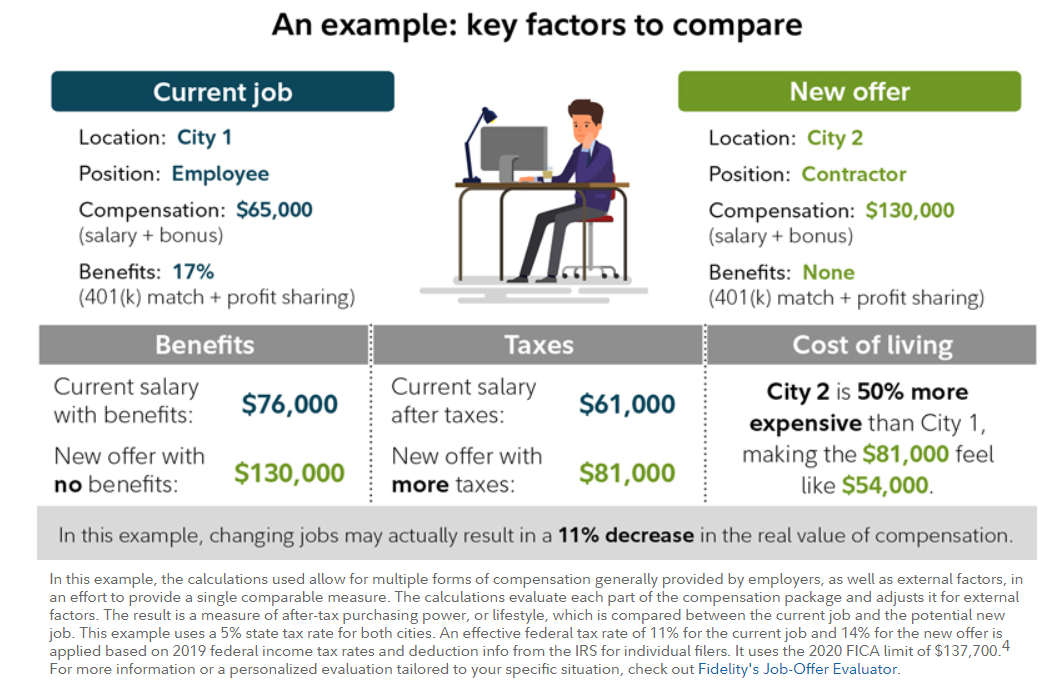

Let's look at a hypothetical example to illustrate the impact of these things. Meet Jason, a 25-year-old computer programmer earning $65,000 in salary and bonus. His employer matches 7% of his contribution to his 401(k) and gives him 10% in profit sharing. He receives an offer from a company in another city as a contractor—so no benefits, and he would be liable for the additional payroll taxes—paying him $130,000 in salary and bonus.

If you were to just look at the salary, wow, he's getting a 100% raise. But there is more to the story. When you factor in his employer match and profit sharing, he made $76,000 last year in his current job (not $65,000)—so the raise benefit drops from 100% to 71%. Of course, profit sharing contributions can change, so his total compensation could go up or down in coming years.

Then there are taxes. Because Jason would be a contractor in his new job, he'd have to pay additional payroll tax, as well as higher state tax and a higher federal tax because he is making more money—so the raise drops to 36%. His new city is an expensive place to live—it is 50% more expensive than where he currently lives. So, putting all those factors together, Jason may actually experience a 8% decrease in the real financial value of his compensation if he took the job.

Those are just the quantifiable aspects of a job change. Fidelity’s tool can’t evaluate the qualitative impact of a change in job status—moving from full time to contractor or vice versa. If Jason can’t save for retirement at the same rate without a match from his employer, that could likely affect his future. Your new job offer may not seem to be in stark contrast to your current, but the bottom line is that when comparing jobs, it’s important to look beyond salary and think about all aspects of compensation.

Run your numbers

Now that you have a sense of what to keep in mind when weighing a new job offer, compare some financial factors of the new job offer vs. your current one with our Job-Offer Evaluator.

Deciding

Of course, your decision shouldn't be just financially oriented. There are many reasons to move from one job to another. Maybe the new job is in a place where you really want to live. Maybe it offers a chance to advance your career. Or maybe it's in a field that you would find more exciting and rewarding. Consider the corporate culture and who you would be working for and with. Vacation days, health care benefits, and maternity or paternity leave are also valuable benefits that may be important to you. What will the commute be like, and how much will it cost? Will you be working long hours? In the end, when making a decision on a job offer, think beyond the paycheck.

1. Wage-earning employee is defined as receiving a W-2.

2. Self-employed contractor is defined as receiving a 1099.

3. To repay an outstanding loan from a workplace savings plan, you’ll have until the tax-filing deadline (with extensions) for the year you left the job, or when the loan offsets, to roll over the balance of your former loan. If you left your job in December 2019 and the loan was offset in February 2020, you would have until October 15, 2020. You can repay yourself by rolling your account out of your former employer’s plan and into an IRA or a new employer’s plan. If you are able to put the outstanding amount of the loan back (the amount of the loan offset) into an eligible retirement plan within the allowed time frame, no taxes or penalties would be due.

4. Deductions are assumed to be the standard deduction. To the extent you have large deductions in excess of the standard deduction or you are subject to AMT, the above may significantly over- or underestimate your federal tax expense. It does not calculate actual tax liabilities or benefits and, therefore, should not be used for tax-planning or tax-reporting purposes. Any tax estimates and tax information provided are not, and should not be construed as, legal or tax advice. While reasonable efforts are made to use and maintain the most current rates, income tax brackets, and other tax rules for estimating taxes, there may be a delay between when new actual tax rates, brackets, and other rules become effective and when the above is updated to reflect them.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Investing involves risk, including risk of loss.

For illustrative purposes only.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917