Managing Your Cash Flow in Retirement

By: Fidelity Viewpoints

Published: August 25, 2021

Key takeaways

- Balance cash flow and liquidity. Holding too much cash may mean you miss out on investing opportunities. But make sure to have enough liquid assets to cover ongoing expenses.

- Consider categorizing your needs as shorter- and longer-term, as a way to manage cash flow.

- Take advantage of web-based and smartphone technology to manage day-to-day financial transactions easily from anywhere.

Whatever the size of your nest egg, retirement will likely mean big changes in your financial life. Sources of income can shift, as can expenses. Financial priorities often change as well as you move from saving for retirement to generating income from your hard-earned retirement savings.

"For many retirees, having a cash cushion can help provide peace of mind," says Klara Iskoz, vice president of Fidelity Financial Solutions. "Although they have the ability to take distributions from their 401(k)s or IRAs, many people don't want to sell off invested assets to pay for unexpected expenses."

Balancing act: cash flow vs. liquidity

When it comes to managing cash flow in retirement, there are 2 key concepts to understand: cash flow and liquidity.

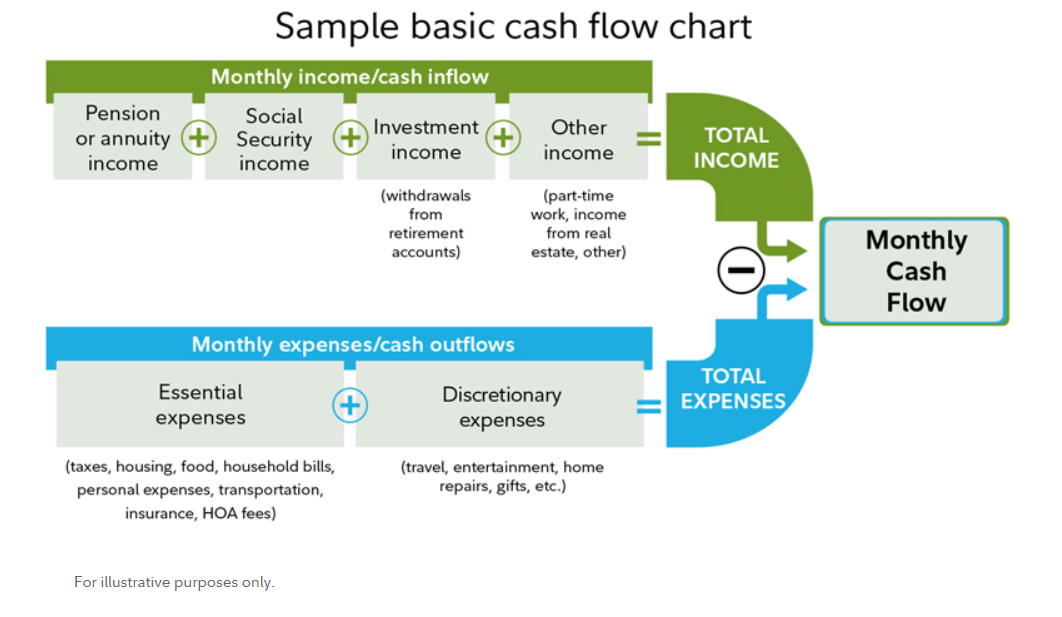

Cash flow simply means the amount of cash you have coming in and going out each month (see chart below). Think about it as mapping your income versus your expenses. If you anticipate risk factors that can often come with retirement (health care expense, a downturn in the market, or a family emergency) then consider increasing your position in cash (or cash equivalents like Treasury bills, CDs, and money market accounts).

Liquidity refers to the ease of turning an asset to cash—and how quickly you can access that cash. The easier an asset can be converted to cash, the more "liquid" it is. For example, your cash holdings in your brokerage account are more liquid than your house. Similarly, you can sell shares in a mutual fund to pay for expenses. However, you can't immediately convert certain insurance policies into cash (without generally paying penalties or surrender fees) or quickly sell valuables such as art or coin collections.

Like many challenges in retirement, this is also a balancing act. If you have too much money in cash, you can be missing out on potential growth. At the same time, you'll want to consider which assets will be available to you over the next few years to help pay ongoing expenses in retirement.

Managing your retirement income

To start, consider the ways that retirement can change cash flow. Your weekly or biweekly paycheck may be replaced by income from a variety of sources, including Social Security benefits, pension distributions, and annuity payments. If you are age 721 or older, the IRS mandates that you take required minimum distributions (RMDs) from your retirement accounts. Some retirees may also generate income from part-time employment, real estate rental income, or sales of assets.

To help manage a variety of income sources efficiently, you can set up direct deposit services, or use a financial institution that offers remote deposit—meaning you can log on to your computer or smartphone and scan or snap a photo of a check.

Spending patterns will also likely change, reflecting both your new lifestyle and shifting financial responsibilities. When you retire, often nothing is being withheld for state and federal income taxes, so you may be responsible for any quarterly estimated taxes. Likewise, most retirees generally have to pay health care and other insurance premiums directly to the insurance carrier(s). Some retirees may also find they are traveling more or living in dual residences. All these situations can make monthly bill paying even more complicated.

Tip: Learn how to take advantage of web-based and smartphone technology that makes it easy to effectively manage your day-to-day financial transactions from anywhere. Doing so can eliminate worries about paying the mortgage bill, no matter where you happen to be.

Manage your shorter- and longer-term cash flow

At any point in your retirement, your income streams may be producing more cash than you are spending. If so, you'll want to think about how to continue to invest that excess cash flow to help meet both your near-term liquidity needs and longer-term needs for both income and growth. When investing, be sure to make liquidity—how quickly you need access to your cash—a central consideration.

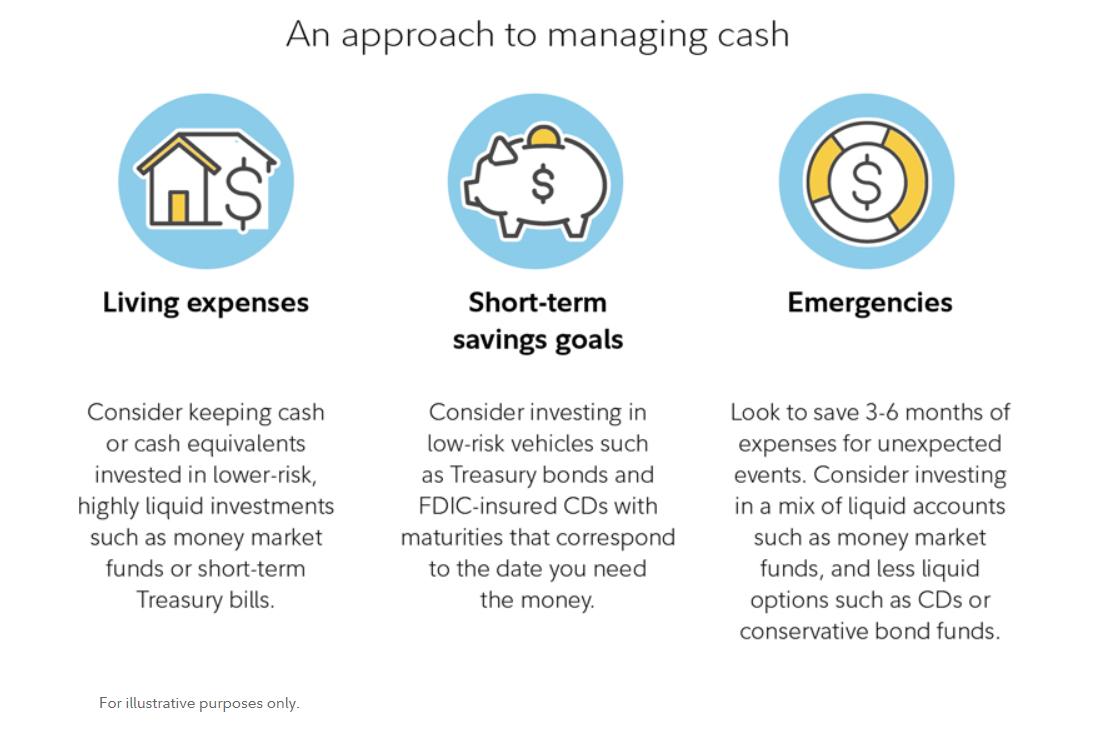

One approach to consider is to manage cash separately for different shorter- and longer-term needs, such as living expenses, short-term goals, and emergencies. Here are some ways to implement each:

Read Viewpoints on Fidelity.com: Budgeting for retirees

Managing cash when you take your RMDs

For many retirees, estimating and taking Required Minimum Distributions (RMDs) once you reach age 722 plays a big role in managing cash in retirement. "If you're planning to spend your RMDs to cover your ongoing retirement expenses," says Iskoz, "you may want to consider having the money sent directly to a cash management or bank account that provides helpful cash management tools."

RMD distributions can also be a time to rebalance your asset allocation. For example, as you get older, you'll likely want to sell off higher risk investments and take proceeds from RMDs (after you pay your taxes) and put them into more conservative investment options.

Ordinarily, you have until December 31 each year to take your RMD. You can opt to take one-time distributions for your RMDs year after year, but the easiest way to satisfy your RMD is by setting up automatic withdrawals and potentially avoid paying penalties if you forget to take your RMD.

Read Viewpoints on Fidelity.com: Smart strategies for required distributions

Look for flexibility and convenience in a cash management account

The key to managing cash in your retirement is to make sure your money can be easily accessed, moved, and invested according to your needs, and, ideally, to do so in a way that mitigates overall fees. Look for a provider that offers options to easily transfer money from your retirement accounts, such as IRAs, into your cash account.

Some firms offer periodic withdrawals to help you create a "just-in-time" income stream and allow remaining assets to produce potential earnings until you need more cash. If you are spending less than you expected, consider setting up access to a sweep system that automatically reinvests excess cash.

It's important to choose reliable financial institutions that provide the features you need to make your retirement finances easy to manage, affordable, and flexible. Consider an account that offers:

- Mobile deposit

- Online access

- Free checks

- The ability to speak with a representative by phone or in person

- The option for a spouse or authorized person to act on your behalf

- The ability to link accounts across different banks and brokerage firms

Tip: If FDIC coverage is important to you, make sure that your cash accounts don't exceed the maximum covered by the Federal Deposit Insurance Corporation, which insures individual bank accounts for up to $250,000 per institution.

A clear picture helps you keep tabs on your finances throughout retirement

Finally, the retirement cash management system you create with your providers should offer a comprehensive view of your finances. Being able to access concise, up-to-date reports on your cash balances, transactions, and assets is a basic requirement and can help prevent unpleasant cash flow surprises.

Now that you’re retired, take advantage of ways to streamline how you manage cash and pay bills. Your cash needs will change over the course of your retirement, so working with your Fidelity advisor to think through the "what ifs" of future cash management also means making decisions about how to use your financial resources during a retirement that may stretch 30 years or more.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

1. The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

2. If you have an IRA, you may delay taking your first RMD until April 1 of the year after you turn 72. If you choose to delay your first RMD, you're required to take your first and second RMD in the same tax year. For your workplace retirement accounts, if you are still working and don't own 5% or more of the business you’re employed by, you may be able to delay taking an RMD until April 1 of the year after you retire. This rule does not apply to IRAs or plans with companies you no longer work for.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

You could lose money by investing in a money market fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund and you should not expect that the sponsor will provide financial support to the fund at any time.

Treasury bond fund interest dividends are generally exempt from state income tax, but are generally subject to federal income tax and alternative minimum taxes and may be subject to state alternative minimum taxes.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible.

For the purposes of FDIC insurance coverage limits, all depository assets of the account holder at the institution issuing the CD will generally be counted toward the aggregate limit (usually $250,000) for each applicable category of account. FDIC insurance does not cover market losses. All the new-issue brokered CDs Fidelity offers are FDIC insured. In some cases, CDs may be purchased on the secondary market at a price that reflects a premium to their principal value. This premium is ineligible for FDIC insurance. For details on FDIC insurance limits, visit FDIC.gov.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917